Reassessed property values drop an average $100 K in San

Benito

For the first time since 1972, when county staff first started

tracking income from property taxes, San Benito County experienced

an overall decline in the most stable form of revenue.

”

I don’t think we’ve ever had any negative growth,

”

said Tom Slavich, the county assessor.

Reassessed property values drop an average $100 K in San Benito

For the first time since 1972, when county staff first started tracking income from property taxes, San Benito County experienced an overall decline in the most stable form of revenue.

“I don’t think we’ve ever had any negative growth,” said Tom Slavich, the county assessor.

Property taxes, a category that includes residential, commercial and agricultural properties, declined by 1 percent between January 2007 and January 2008, according to the 2008 assessor’s report. That is a $70 million reduction, though much of the money collected stays at the state level.

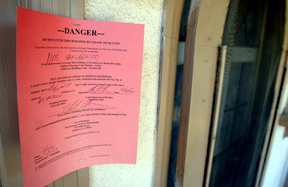

Due to Hollister’s sewer moratorium and low growth in the unincorporated areas, there was not enough commercial growth to offset falling residential property values, Slavich said.

Slavich reduced the value of nearly 2,700 homes by $294 million. The average house value fell by $100,000.

In April, Slavich predicted that he would reduce the value of 2,000 homes by $100 million, a third of the actual devaluation.

He did not expect that so many properties would decline in value, or the high foreclosure rate, he said.

“The reductions that we’ve granted are temporary reductions,” he said.

Proposition 13 sets a home’s value at the time of purchase as the base value, Slavich said. It allows an annual 2 percent increase.

The county assessor’s job is to establish a home’s value as of Jan. 1. If the fair market value is lower than the purchase value, then Slavich makes a reduction.

“If there was a major turnaround from here to Jan. 1, then we would start increasing those values upwards to their prop 13 values,” Slavich said.

Property taxes make up the largest part of the county’s discretionary budget.

“The impact to us is another $436,000 less than we anticipated for our adopted budget this year,” said Susan Thompson, the county administrative officer.

That loss from property taxes might be offset by other gains, Thompson said.

“We had estimated that our employee medical premiums would increase by about $145,000 over last year,” Thompson said. “That did not happen.”

Other mitigating factors include an additional $173,000 from state officials for road projects and $31,000 more from a state sales and use tax than estimated in the budget, she said.

County officials have had a hiring freeze for more than a year and a purchasing freeze since May, Thompson said.

“We’ve already achieved some savings,” Thompson said. “I will know what those numbers actually are within a couple of weeks.”

Thompson planned to report to county supervisors at the Sept. 23 or Oct. 7 board meeting.

Property tax change between January 2007 and January 2008

Santa Clara County – 6.9 percent increase

Santa Cruz County – 3.3 percent increase

Monterey County – 2.3 percent increase

Merced County – 2.4 percent decrease

San Benito County – 1 percent decrease

Residential property value reductions

Santa Clara County – $5 billion

Monterey County – $2.4 billion

Santa Cruz County – $670 million

San Benito County – $70 million

Merced County – $1.3 million

Source: Tom Slavich, assessor for San Benito County