Unlike the federal government, San Benito County has to balance

its annual budget. A lot of finagling still goes on; however,

balancing the budget can impart some sense of fiscal reality. I’ll

try to draw you a word picture of the county’s financial

situation

– bleak, cheerless, dark, discouraging, disheartening, dismal,

dreary, gloomy, grim, harsh, joyless, sad, somber, and

unpromising.

Unlike the federal government, San Benito County has to balance its annual budget. A lot of finagling still goes on; however, balancing the budget can impart some sense of fiscal reality. I’ll try to draw you a word picture of the county’s financial situation – bleak, cheerless, dark, discouraging, disheartening, dismal, dreary, gloomy, grim, harsh, joyless, sad, somber, and unpromising.

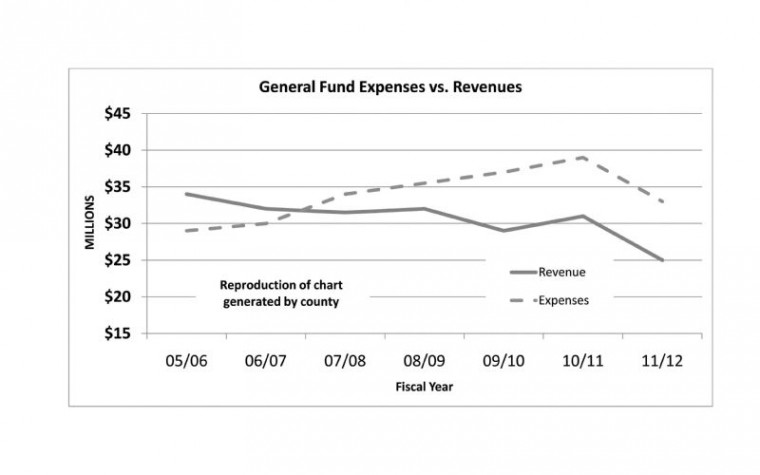

After five years of questionable budget increases, the last four funded with deficit spending, the board of supervisors had to react to drastically falling revenue projections. The board adopted a $33 million General Fund budget for FY 2011-12 that cut 15 percent from the previous year’s $39 million. The problem is the forecasted revenue dropped from $31 million to $25 million, the same amount as the cut. This produced an $8.6 million annual deficit, the fifth deficit in as many years and the third in a row in the $8 million range. The cuts may be a case of too little, two years too late. As Supervisor Jerry Muenzer remarked, we need to start closing the gap between expenses and revenues.

The five years of continuous deficits now total $30 million. Conservative estimates from last year yielded a welcome $3.2 million rollover. However, there is a big difference between saving 8 percent of a $39 million budget versus trying to save on a $33 million budget, so future rollovers are in doubt. Adjusting for the $7 million surplus from way back in FYs 2005 thru 2007, these last five years have cost county taxpayers $23 million from various sources and reserves just to cover General Fund expenses.

After the rollover, the board still needed $4.8 million to balance the shrunken budget. It came from a hodge-podge of account shifting, re-assigning and payment deferrals. Among other things, they added revenues of $297,000. Canceling one loan and shifting another to the capital account – both onetime shots – netted $1.7 million. Moving funds originally designated to pay for retirement and other post-employment benefits to the unassigned balance produced $2.6 million. Unfortunately, the liability did not go away, just our payments; in fact, the auditor expects a liability increase. Finally, $1.2 million came from the prudent reserve – the bottom line is that we’re eating our seed corn.

It’s important to keep the $23 million and 2.6 million of deferred liabilities in mind. If surpluses ever return departments and employees are going to be clamoring to be made “whole” but reserves must be replenished first so they can be available in times of need; if not, the next problem might be our last. Likewise, growing liabilities must be drawn down if they are not to be a permanent drag on recovery.

I don’t believe the budget committee process can work under the current conditions. We’re not considering slight tweaking; we were still 24 percent in the red after the 15 percent in budget cut. We need massive reform like so many other California political entities are undertaking. Designing workable options is a job for the entire board with complete vetting from day one, not just the two members that make up the committee.

Poor counties are like poor people. They are the first to feel the impact of a bad economy, they have the most serious issues, the least reserves, and they are the last to recover. Time and money are running out. We must change the game or the harmful effects will linger for decades.

Marty Richman is a Hollister resident.