Local wineries honored among best American wines

A number of San Benito County wineries were honored in the 2012 San Francisco Chronicle Wine Competition, which bills itself as the largest competition of American wines in the world. A record 5,500 entries competed for medals that were awarded by a panel of 65 judges, with winners announced Friday.

Fate of Hollister Kmart unclear with closure list coming

SEARS AND KMART - can you imagine America without them?

Gilroy restaurant would feature bikini-clad dancers

If Bob Tapella's vision for the old Jeffrey's Restaurant comes to fruition, patrons will be savoring delicious French Dip sandwiches and a cold beer in a classy restaurant in front, or in the company of bikini-clad beauties in the back.

Hollister’s Heirloom Organics wants you to eat your veggies

Want to freshen up your diet with a little green goodness during the sugar-laden holiday season?

Premiere Cinemas in Hollister gets a bathroom break

It's as clear as clean water: Hollister movie-goers are just fine holding off until home before they use the restroom.

Chamber announces people, businesses of the year

The San Benito County Chamber of Commerce & Visitors Bureau today announced this year’s winners for man, woman and businesses of the year.

Locals win gift baskets from Shop Hop

Local businesses and artistans hosted a Shop Hop Dec. 3, in hopes of promoting shopping within the San Benito Community. As part of the promotion, which included nearly 50 businesses or artisans from Hollister and San Juan Bautista, the local businesses had such an enthusiastic showing during the event that they have planned to have the “buy local” day twice a year. The Spring Hop will be the first Saturday in May, May 5, 2012.

Business Buzz: New taxi business starts in Hollister

There is now a third provider of taxi services in Hollister, with LTD Taxi starting its business in the past month or so.

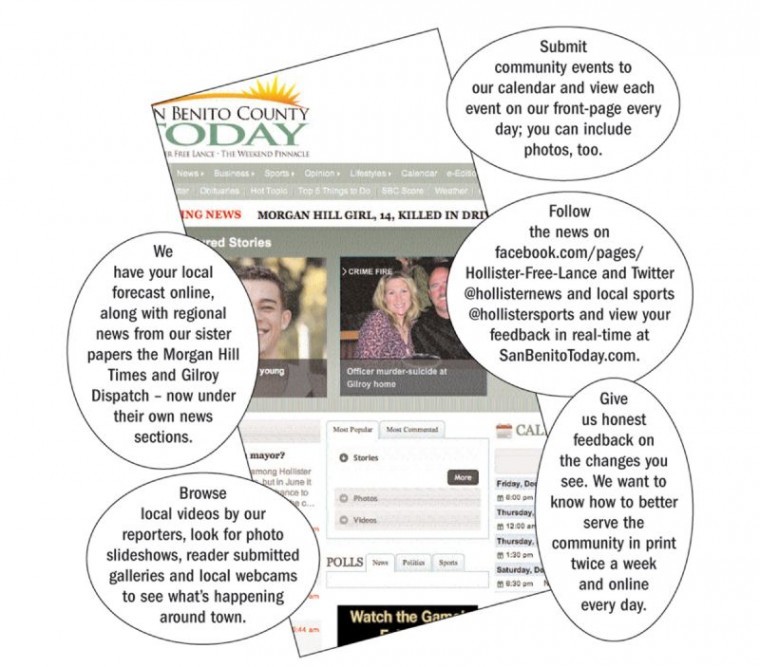

Free Lance to unveil new online platform Wednesday

Starting at noon Wednesday, your local news website will look different – in a way that we're confident will please your online senses and savvy.

Nonprofits honor 47 residents at Philanthropy Day

Many people might agree that what makes San Benito County a great place to live is the people, and that was personified at a recent gathering to honor the community's abundance of volunteers.