Solargen Energy continues to show signs of struggling to meet

initial financial obligations in efforts to build a 399-megawatt

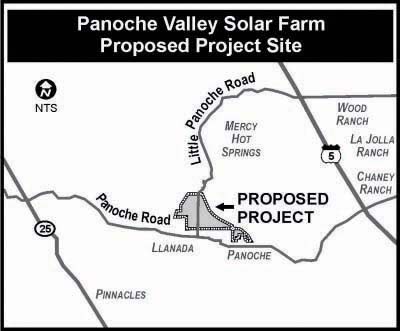

solar farm in Panoche Valley

– as company insiders during the first quarter of 2011 lent

nearly $190,500 for ongoing cash expenses, while outside investors

expressed unwillingness to finance new development costs, according

to the company’s annual report released last week.

Solargen Energy continues to show signs of struggling to meet initial financial obligations in efforts to build a 399-megawatt solar farm in Panoche Valley – as company insiders during the first quarter of 2011 lent about $190,500 for ongoing cash expenses, while outside investors expressed unwillingness to finance new development costs, according to the company’s annual report released last week.

The report released Thursday sheds light on Solargen’s efforts to obtain financing for the estimated $1.2 billion project. One of the more revealing moves by the company, reported in the document, is the need to borrow $190,500 to keep operations going and the fact that the funds came from company insiders.

Solargen in its annual report noted that between Jan. 1 and March 31 it secured promissory notes from board directors and other insiders “to pay for short term capital requirements to operate the business,” according to the annual report for the fiscal year ending Dec. 31. The recent loan amounts range from $10,000 for two of the directors to $89,201 from McAfee Capital, the principal of which is Solargen co-founder and director Eric McAfee, according to the report.

The loans are repayable at an annual interest rate of 10 percent, according to the report. In addition to repaying the loans, Solargen has issued five-year warrants for about 165,000 total shares to those lenders at a strike price of 20 cents.

The company noted in the document how its “net cash used” since inception in 2006 was $8.2 million – and that there was $67,338 remaining in cash and cash equivalents at the end of the period, or as of Dec. 31. In the report, Solargen noted how it has been financed through raising of capital, and how the “existing capital will not be sufficient to cover operating expenses.”

“Our existing investors have not expressed a desire to fund the Company’s ongoing development costs,” according to the report.

Solargen went on to note how it expects to rely on funds raised from debt and equity to cover expenses, such as costs for its eight employees – one of whom is part time, and the rest of whom are directors – and an array of consultants.

“Solargen must raise additional capital, enter into a joint venture agreement with a strong co-development partner who can assist us with financing the project, or find a buyer to keep the project moving forward,” the company said in the report.

The revelations come in light of Solargen missing a February deadline to submit a $7.54 million letter of credit in trying to gain a permit from the California Independent System Operator Corp. CAISO is a nonprofit corporation that operates the majority of California’s high-voltage power grid. To gain access to the power line through Panoche Valley, Solargen must go through that permitting process, which would require a total credit line for all phases of $165 million, according to the company. That money acts as a deposit for Solargen and would be reimbursed by Pacific Gas & Electric upon operation of the project.

Because Solargen missed the February “cluster 2” payment deadline, it had to move to the back of the proverbial line, and it leaves the company’s time frame in question while Solargen noted it intended to participate in CAISO’s “cluster 3” study in March. Solargen, meanwhile, has gained all necessary approvals from the county, while it also is dealing with a lawsuit filed by opponents requesting to halt the project planned for 16,000 acres, with about 2,300 for solar farm development.

The Solargen annual report also noted the following:

– It is definitively not manufacturing any of the solar panels used on the project.

– It has been unsuccessful in seeking a Power Purchase Agreement with a major utility.

– Land option agreements require payments of $485,000 in 2011 and $300,000 in 2012, with the total purchase price, if all options are exercised, at $23 million.

– As a backup plan if there is no PPA agreement, Solargen intends to negotiate contracts with California’s Investor-Owned Utilities (IOUs) and to seek “favorable off-take agreements with municipal utilities and rural irrigation districts.”

Solargen CEO Michael Peterson did not return a phone call before press time.