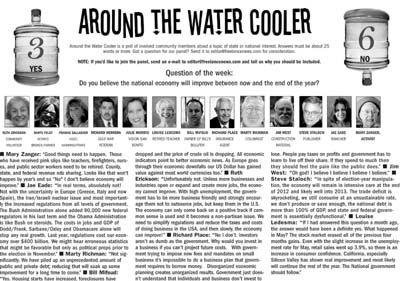

Panelists answered the question: Do you believe the U.S. economy will improve between now and the end of the year?

Mary Zanger: “Good things need to happen. Those who have received pink slips like teachers, firefighters, nurses, and public sector workers need to be rehired. County, state, and federal revenue nds sharing. Looks like that won’t happen by year’s end so “No” I don’t believe economy will improve.”

Jae Eade: “In real terms, absolutely not! Not with the uncertainty in Europe (Greece, Italy and now Spain), the Iran/Israeli nuclear issue and most importantly the increased regulations from all levels of government. The Bush Administration alone added 90,000 new federal regulators in his last term and the Obama Administration is like Bush on steroids. The costs in jobs and GDP of Dodd/Frank, Sarbane/Oxley and Obamacare alone will stop any real growth. Last year, regulations cost our economy over $400 billion. We might hear erroneous statistics that might be favorable but only as political props prior to the election in November.”

Marty Richman: “Not significantly. We have piled up an unprecedented amount of public and private debt; reducing that will soak up some improvement for a long time to come.”

Bill Mifsud: “Yes. Housing starts have increased, foreclosures have dropped and the price of crude oil is dropping. All economic indicators point to better economic news. As Europe goes through their economic downfalls our US Dollar has gained value against most world currencies too.”

Ruth Erickson: “Unfortunately not. Unless more businesses and industries open or expand and create more jobs, the economy cannot improve. With high unemployment, the government has to be more business friendly and strongly encourage them not to outsource jobs, but keep them in the U.S. The economy can only come back on a positive track if common sense is used and it becomes a non-partisan issue. We need to simplify regulations and reduce the taxes and costs of doing business in the USA, and then slowly, the economy can improve!”

Richard Place: “No I don’t. Investors aren’t as dumb as the government. Why would you invest in a business if you can’t project future costs. With government trying to impose new fees and mandates on small business it’s impossible to do a business plan that government requires to borrow money. Disorganized economic planning creates unorganized results. Government just doesn’t understand that individuals and business don’t invest to lose. People pay taxes on profits and government has to learn to live off their share. If they spend to much then they should feel the pain like the public does.”

Jim West: “Oh god! I believe I believe I believe I believe.”

Steve Staloch: “In spite of election-year manipulation, the economy will remain in intensive care at the end of 2012 and likely well into 2013. The trade deficit is skyrocketing, we still consume at an unsustainable rate, we don’t produce or save enough, the national debt is more than 100% of GDP, and state and federal government is essentially dysfunctional.”

Louise Ledesma: “If I had answered this question a month ago, the answer would have been a definite yes. What happened in May? The stock market erased all of the previous four months gains. Even with the slight increase in the unemployment rate for May, retail sales went up 3.9%, so there is an increase in consumer confidence. California, especially Silicon Valley has shown real improvement and most likely will continue the rest of the year. The National government should follow.”