The City of Hollister is saddled with two of the region’s highest CalPERS employer contribution rates now and into the future with costs exceeding more than $3.1 million next year, according an analysis of 24 local area valuation reports.

These costs do not include more than $400,000 the city will pay in retirement premiums on behalf of its employees – raising total retirement costs to $3.5 million on a $10.4 million wage payroll.

Retirement expenses alone will add an average of 34 percent to the city’s wage costs next fiscal year.

The majority of Hollister’s extra costs come from a single factor: Two of the city’s three retirement plans, “miscellaneous” and “police,” are severely underfunded compared with the other members of the risk pools and as a percentage of payroll. Individual underfunded plans are required to make added amortized payments into side funds to eliminate the shortage. Hollister’s total pool shortages, which will fluctuate, are now at $11.5 million – costing the city an extra $1.14 million annually. Unless the city makes substantial, lump-sum payments, amortization of this debt at current rates will phase out over 18 years.

San Benito County’s safety plan is also underfunded by $4.6 million. This requires annual side-fund payments, currently $648,588, which is included in the employer rate.

Of the 14 pool plans analyzed in the region, Hollister police was the most underfunded as a percentage of annual payroll, 155.7 percent; followed by Salinas fire, 146.6 percent; and Hollister miscellaneous, 101.5 percent. The two other pooled miscellaneous plans, Los Banos and the San Benito County Water District, were underfunded less than 30 percent of annual payroll.

Hollister fire was underfunded 78.1 percent of annual payroll, while San Benito County Safety was underfunded 71.2 percent; its amortization is 8 years. Two pooled safety plans in Santa Cruz and two in Watsonville are paid up and will no longer contribute to side funds starting in fiscal year 2012-13.

Agencies compared

The analysis looked at 13 CalPERS police, fire, and safety retirement plan valuations in Hollister, the City of Monterey, Los Banos, Gilroy, Morgan Hill, the City of Santa Cruz, San Benito County, Salinas, and Watsonville and 11 miscellaneous CalPERS valuations for all the above plus the San Benito County Water District and Monterey County. Eight of the Miscellaneous and two of the Safety plans are independent, although CalPERS sets the rates.

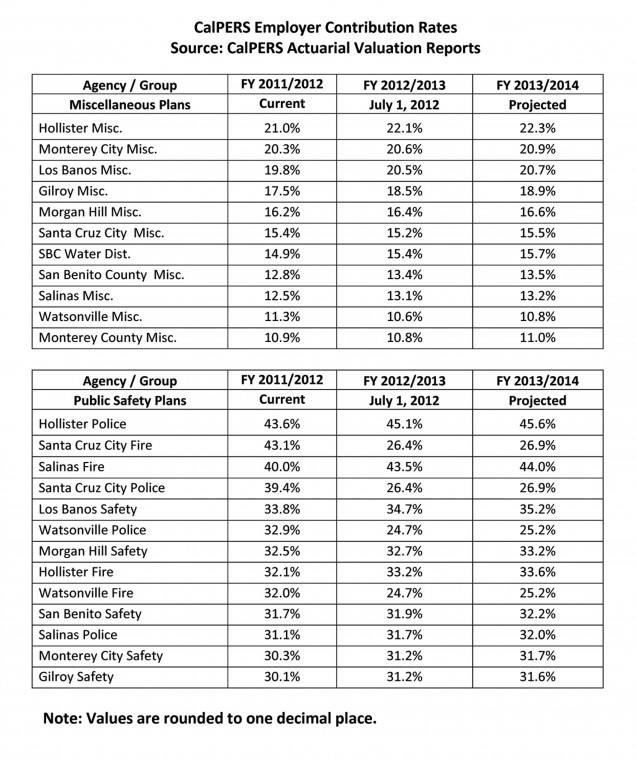

Present and future rates (see table)

This year’s employer contribution rate for Hollister police is 43.6 percent of payroll – the highest among the 13 safety, police and fire organizations in the area. Rates of other safety agencies ranged from 30.1 percent to 43.1 percent, averaging 34.1 percent. Hollister’s rate for 2012-13 will increase to 45.1 percent while the average comparison rate will to drop to 31.0 percent.

Hollister’s miscellaneous employee rate, 21 percent, was the highest among 11 miscellaneous agencies. The other rates ranged from 10.9 percent to 20.3 percent, averaging 15.2 percent. Hollister’s rate for next fiscal year will increase to 22 percent while the average for the comparison agencies will increase to 15.5 percent.

The rate for Hollister fire, 32.1 percent, was the eighth highest and slightly below average among public safety agencies that included Hollister police. This rate will increase to 33.2 percent in 2012-13.

There were significant rate differences between Hollister and San Benito County, two organizations that are essentially co-located. San Benito County paid 31.7 percent for its “Public Safety Plan” and its “Miscellaneous Employee” self-funded plan rate was 12.8 percent. Both county rates will also increase slightly next fiscal year.

Common misconceptions

Elected officials, staff and the public often have misconceptions about how plan rates are determined. Many believe that rates are no longer affected once an employee leaves or retires. Payments are actually based on “actuarial assumptions including the age when members are expected to retire, how long members are expected to live and economic factors that may affect the value of benefits or the value of assets held in a pension plan’s trust fund (e.g., investment return rate, inflation rate, and rate of salary increases).”

It is a complicated process, but CalPERS periodically publishes a report for each plan that specifies the valuation parameters, including the personnel count basis. As of June 30, 2010, Hollister’s miscellaneous plan was based on 87 active, 39 transferred, 31 separated, and 100 retired members. Hollister’s police valuation was based on 26 active, 24 transferred, 7 separated, and 42 retired members while the fire department’s was based on 25 active, 13 transferred, 5 separated, and 13 retired members.

Plan rates also include adjustments for long-term valuation changes. That amount is currently plus 4 percent for Hollister’s miscellaneous plan and over 5.9 percent for the police and fire plans.