Hazel Hawkins Memorial Hospital’s financial advisors and administrators assured the public at a crucial May 22 meeting that a Chapter 9 bankruptcy filing is their only option to keep the Hollister hospital functioning—though perhaps eventually with reduced services—and would not result in a closure of the medical facility.

Still, nurses who work at HHMH worry that the hospital’s bankruptcy will encourage top staff and administrators to regain Hazel Hawkins’ financial solvency at the expense of employees and patients. Dozens of nurses—most wearing red clothing—held a rally outside the hospital before the May 22 board session and packed the district meeting room as they urged the elected directors and district officials to seek options other than bankruptcy.

After hearing from both sides, the five-member San Benito Health Care District Board of Directors voted unanimously at the May 22 meeting to file for Chapter 9 bankruptcy—a decision that has been on the table since the board declared a fiscal emergency in November 2022.

“For the past several months we have done all we can to shore up our finances, cut costs and collect advance payments where we can, but this decision allows us to deal with larger issues we just can’t tackle outside of Chapter 9,” HHMH and district spokesperson Marcus Young said in a statement following the board’s May 22 decision.

The board also voted May 22 to adopt a “pendency plan” triggered by the Chapter 9 filing. The pendency plan permits HHMH to make financial decisions designed to carry it through bankruptcy while it seeks a long-term or permanent partner or buyer. The plan will allow the district to modify its current finances to more easily market Hazel Hawkins to an outside entity, or restructure its operations with reduced services, according to district staff and advisors.

Following the board’s May 22 decision, HHMH staff listed four key components that will follow in an effort to financially revive the hospital: officials can modify contracts for employees’ healthcare benefits that currently cost the district more than $15 million annually; HHMH will stay open “and fully operational during the (bankruptcy) process;” HHMH can accelerate its search for a partner or buyer; and the court can appoint an ombudsman to monitor the quality of care provided by HHMH.

“We want this community to know that our hospital is open and caring for patients every day—we are not closing,” Young added. “From the very start, our goals have been clear—find a way to continue to offer the best care for our community. This filing is one of the ways we can achieve that goal.”

But local hospital services could be reduced as the bankruptcy proceeds. Union-represented employees could also see some changes in their benefits, as the Chapter 9 filing allows the district to unilaterally restructure its contracts with such groups. Still, a district staff report notes that “the district anticipates maintaining wages at a similar or identical level as it currently provides to employees.”

District advisors noted that Hazel Hawkins’ labor costs are the hospital’s largest expense. Under the pendency plan, the district expects to adjust its benefits for employees in a number of ways: increasing premiums for employee health insurance so they are more in line with similar institutions; terminating “defined benefit plans” in the future while honoring existing liabilities; combining all employee leave benefits into a single paid leave category capped at 30 days per year; and modifying standby compensation and education benefits.

If implemented by July 1, these changes could improve the district’s cash flow from a projected deficit of $6.1 million (without a Chapter 9 filing) for calendar year 2024 to a $1.5 million deficit for the same year, according to district staff and advisors.

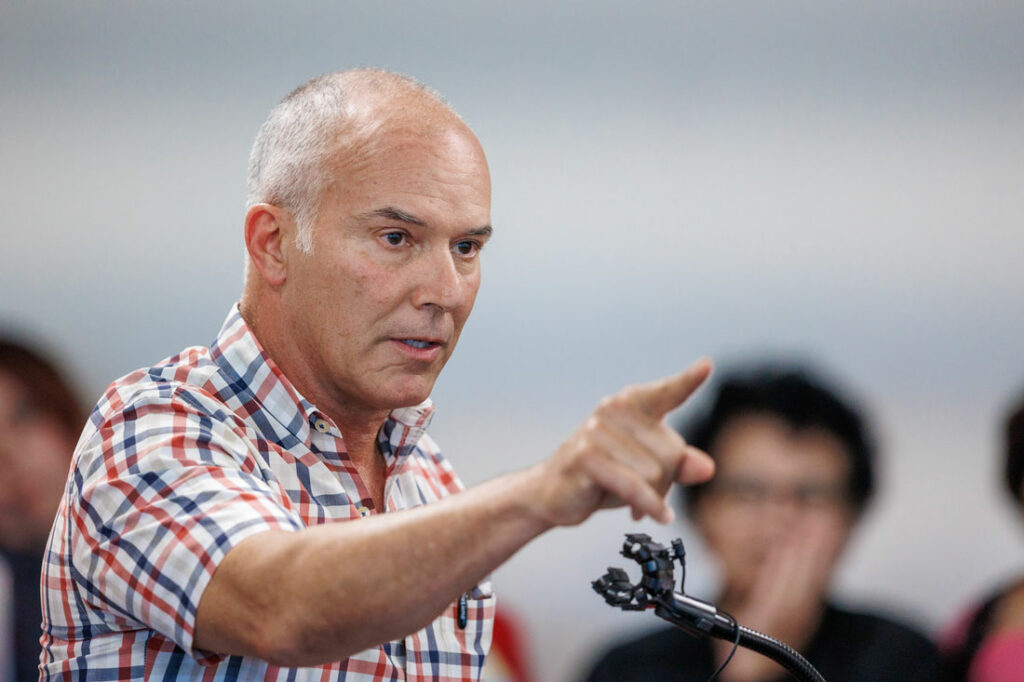

Several nurses employed by HHMH, and represented by the California Nurses Association, spoke during the public comment portion of the May 22 meeting. They asked the board to be more transparent about the hospital’s finances and avoid taking any action that could jeopardize public health by reducing local healthcare services.

Some of the nurses blamed the hospital’s ongoing struggles on HHMH leadership.

“They have refused to offer transparency by opening their financial books or making cuts from the top,” said Diane Beck, a Registered Nurse at HHMH. “We want a strong community run hospital that ensures the highest level of patient care. The hospital administration has been recalcitrant and refused to do what is right. It is time for you as a board to demand accountability for our failed leadership.”

The CNA, which represents about 120 nurses employed by HHMH, organized a rally outside the hospital on Sunset Drive before the Monday evening meeting. Nurses held signs and union representatives chanted into bullhorns demanding more accountability from district and hospital leaders.

Since the district board declared a fiscal emergency in November, the hospital has taken a number of short-term efforts to financially stabilize HHMH’s position. These include property tax revenue advances; a $3 million loan from the state; the sale of a surplus property on Maple Street valued at $1.6 million; savings that include staff reductions, deferred wage raises and a hiring freeze; and other efforts, according to district staff.

Also since November, the district has been in discussions with outside entities who may be interested in partnering with or purchasing HHMH. The details of these discussions have not been revealed, but district advisors from B. Riley Financial and the Fox Rothschild law firm think the filing of Chapter 9 could enhance interest from potential partners or buyers.

But these efforts have not been enough to propel HHMH to a sustainable financial position necessary to maintain and increase healthcare services demanded by the growing San Benito County community.

“The district’s current cash flow forecast confirms that the short-term stabilization initiatives were successful to increase the district’s cash-on-hand but will not be sufficient to establish a long-term restructuring of the district’s liabilities,” says the staff report for the May 22 meeting. “(Following) implementation of the short-term stabilization initiatives, the district is still projected to operate at a $6.1 million cash shortfall in 2024. This will result in the district running critically low on cash by August 2024 and exhausting all cash by November 2024, assuming operations remain the same.”

Other options in the district’s bankruptcy pendency plan for HHMH include drawing on a $10 million line of credit; seeking state funding; and, in the third and final phase of the plan absent an agreement with a buyer or partner, continued independent operation of the hospital with services reduced enough to generate an ongoing positive cash flow, says the staff report.

Mon ami,

Insolvency is a sad part of life, but the federal Bankruptcy Code is an obvious solution as solutions go with the law. Like surgery, it may leave a scar, but considering the pros and cons, there are many precedents upon which we can draw, e.g., City of Stockton.

But what if you are conceived insolvent, and born bankrupt? San Jose Bus Lines, Inc., became insolvent. So, bankruptcy was the obvious solution. So, why does COG, which has been insolvent since the day it was enacted, like all the other transit agencies, get to stay “in business,” and is not, like others, put into reorganization under Ch. 9? If COG makes only 1% of its total costs from fare paying customers, I see no reason why it, too, should not be in Ch. 9. They don’t even level with the taxpayers because their financials are not prepared using GAAP accounting, which IRS regs require everyone to use. COG (and the other transit agencies) use Bernie Madoff-style, Enron-style, “off-book” accounting, omitting their capital and fixed costs, to make them look less insolvent than they are. And their fares are priced below cost. If one of my clients did that, they’d be busted for violating the Unfair Business Practices Act, and False Advertising, and probably RICO. COG reminds me of a sacred cow, allowed to walk thru the County eating anything and everything it wants. Same for VTA, TAMC, SCCRTC, FAX, MTA, etc., all of them. If COG was a horse, we would shoot it. Now Senator Weiner is proposing that the California taxpayers give the insolvent transit agencies $5B. And now long will that go on, and on . . . At least Ch. 9 has viable solutions. But perpetuating empty bus seat transport at taxpayers expense is governance abuse at its worst. Caveat viator. Joe Thompson, Charter-Member, SBCCOG Citizens Transit Task Force; Charter-Member, SBCCOG Citizens Rail Advisory Committee; Past-President 1999-2001, 2006, Gilroy-Morgan Hill Bar Assn., Past-Chair, Legislation Committee, Transportation Lawyers Assn. (408) 848-5506: E-Mail: Tr******@*****ll.Net