A new investment group has purchased Solargen Energy’s assets,

while the corporation from this point will go by the title Nevo

Energy, according to a financial statement filed Friday.

A new investment group has purchased Solargen Energy’s assets, while the corporation from this point will go by the title Nevo Energy, according to a financial statement filed Friday.

A company called PV2 Energy, which formed March 18, acquired the solar farm company’s assets in a deal made definitive April 19, according to the document listed under Solargen Energy’s financial statements on the over-the-counter markets, along with state documents showing when PV2 became a limited liability corporation.

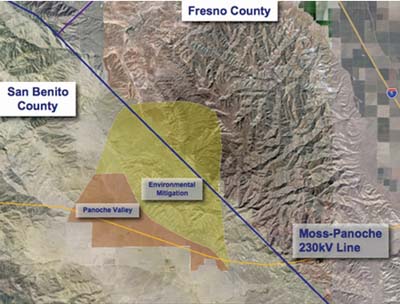

Solargen Energy’s plans had been in the works for about four years to build a 399-megawatt solar farm on nearly 5,000 acres in southern San Benito County and estimated to cost $1.2 billion. Supervisors last year approved the project and its environmental impact report and, in their support, largely cited potential economic benefits.

The project, which could receive 30 percent of capital upstart funds from the federal government, has faced opposition over environmental concerns from some landowners in the Panoche Valley area and also from broader groups taking part in an active lawsuit trying to halt it.

Most recently, though, Solargen Energy’s investors have faced more pressing difficulties raising the necessary capital to get the project off its feet, as company directors in the first fiscal quarter of the year were forced to lend a total of $180,000 for ongoing operations because primary investors were unwilling to do so. Solargen’s slow movement with fundraising, in the meantime, has hampered efforts in connecting to the power grid and seeking a “power purchase agreement.”

In the filing from Friday, the company explained how the new investors would “bring the necessary resources to complete the development of the photovoltaic solar project located in San Benito County, California.”

The new company overseeing the Panoche Valley solar farm – the project itself will keep the Solargen name – goes by PV2 Energy. The listed agent, Norman Villarina, also has a separate filing with the California Secretary of State’s Office under PV2 Land Holding, LLC, which formed March 21, though it is unclear what intentions new investors might have with the two separate companies when pertaining to the Solargen project. Villarina is based in San Francisco where he is a partner in a company called Industry Capital. He did not immediately return a phone call before press time.

While the new company will continue using Solargen Energy for the Panoche Valley project, the corporation itself will be identified as Nevo Energy, according to Solargen’s filing.

The filing Friday noted that Solargen shareholders will continue to “have a financial stake” by being paid 15 percent of net proceeds received by PV2, and how “certain Solargen employees and many of the Company’s vendors will continue to be dedicated to moving the project toward completion.”

Solargen CEO Michael Peterson did not return phone calls over the sale but included a statement in the latest filing, lauding county officials for working to get the project this far and making it viable.

“PV2 and its principals have the experience and ability to secure the financial resources to fund the Project through the remaining stages of development and on to construction.”

But county officials weren’t necessarily as rosy as Peterson about the transaction.

First-year Supervisor Robert Rivas, who joined the board after its approval of the Solargen project, said he believes the county ended up getting “a raw deal.” Rivas noted how he had opposed the project, and contended that Solargen’s executives “fell short” of being “honest and transparent” through the process.

He said the transaction “reinforced” what he felt after meeting months ago with Solargen officials.

“They were only here in our county, in San Benito, to make a profit,” Rivas said. “They were not willing to do the hard work and necessary work to help mitigate the environmental concerns, to really talk about job creation.”

Supervisor Jaime De La Cruz said the change of hands wasn’t a concern as much as ensuring the agreement’s requirements are fulfilled.

Supervisor Margie Barrios remained optimistic about the project’s future and about the company providing “much-needed energy resources for decades.” She also noted how the federal capital funds would be reimbursed in phases, making it more difficult to obtain necessary, private financing.

“I think this is what they needed,” Barrios said. “They needed a company with financial resources.